EV sales will continue to grow despite the mixed near-term outlook, according to a new report from BloombergNEF – here’s why.

BloombergNEF’s Long-Term Electric Vehicle Outlook (EVO) indicates that rapidly falling battery prices, advancements in next-gen battery technology, and improving relative economics of EVs with ICE counterparts continue to underpin long-term EV growth globally. However, the report indicates that the window to reach global net-zero transport is now narrower than ever. Here are seven top-line findings that I pulled from the report:

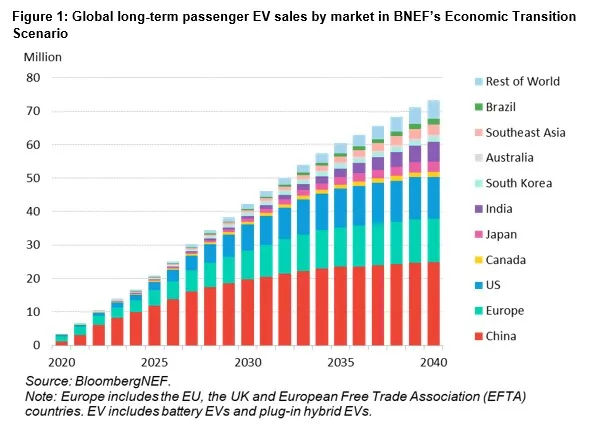

Global passenger EV sales continue to grow, but at a slower pace in the next few years than before.

Passenger EV sales are expected to exceed 30 million in 2027 in BNEF’s base case scenario and grow to 73 million per year in 2040.

In the next four years, electric car sales grow at an average of 21% per year in BloombergNEF’s Economic Transition Scenario – in which EV adoption is shaped by current techno-economic trends and with no new policy intervention – compared to the average of 61% between 2020 and 2023.

The EV share of global new passenger vehicle sales jumps to 33% in 2027, from 17.8% in 2023. Only China (60%) and Europe (41%) are above that global average by then. EV sales in Brazil quintuple by 2027 and triple in India.

ICE vehicle sales have peaked. ICE vehicle sales peaked in 2017 and by 2027 are 29% lower than their peak in the report’s outlook. BloombergNEF says its economic analysis indicates that EVs are the primary method of decarbonizing road transport. It also asserts that hybrids can play a meaningful role in the near term, in particular in markets with increasingly stringent fuel-efficiency rules. Hybrid adoption reaches between 5% and 45% of sales by 2030 in its outlook, depending on the market.

Electric heavy trucks become economically viable for most use cases by 2030. In heavier segments, battery electric trucks are mostly used in urban duty cycles at first. But their economics improve even for long-haul routes and around 2030 approach those of diesel powertrains. The outlook on fuel-cell trucks is far less certain.

Lithium-iron-phosphate batteries (LFP) are taking over the EV market. Improvements in LFP technology are increasing its market share, particularly in China, where cell prices have fallen rapidly to $53/kWh so far this year. LFP crosses 50% share of the global passenger EV market within the next two years in BloombergNEF’s outlook. Nickel and manganese are set to feel the most pressure as a result. Due to the shift toward lower-cost chemistries, nickel and manganese consumption by 2025 is 25% and 38% lower, respectively, this year than in the previous outlook.

To meet the growing EV electricity demand, the charging industry will need to mature rapidly over the next decade. Between $1.6 trillion and $2.5 trillion in cumulative investment is required in charging infrastructure, installation, and maintenance by 2050, depending on the scenario.

Overcapacity is a big issue for battery makers. Planned lithium-ion cell manufacturing capacity by the end of 2025 is over five times the 1.5 TWh global battery demand expected that year. Annual lithium-battery demand grows rapidly in BloombergNEF’s Economic Transition Scenario, approaching 5.9 terawatt-hours annually by 2035.

Reaching a global zero-emission fleet by 2050 needs a much faster transition. Despite the progress, global road transport is still not on course for a net-zero trajectory. By 2035, there are 476 million EVs on the road, rising to 722 million by 2040, accounting for 45% of the fleet. In the net zero by 2050 scenario, this is 679 million and 1.1 billion, respectively.

BNEF’s net zero scenario calls for 100% of the road-going car fleet to be electric by 2050, but its base case Economic Transition Scenario only achieves 69% in 2050.

Read more: Germany is No 1 in Europe for EV production, No 2 in the world

If you live in an area that has frequent natural disaster events, and are interested in making your home more resilient to power outages, consider going solar and adding a battery storage system. To make sure you find a trusted, reliable solar installer near you that offers competitive pricing, check out EnergySage, a free service that makes it easy for you to go solar. They have hundreds of pre-vetted solar installers competing for your business, ensuring you get high quality solutions and save 20-30% compared to going it alone. Plus, it’s free to use and you won’t get sales calls until you select an installer and share your phone number with them.

Your personalized solar quotes are easy to compare online and you’ll get access to unbiased Energy Advisers to help you every step of the way. Get started here. –affiliate link*

FTC: We use income earning auto affiliate links. More.